atc income tax india

Tax Return Preparation Bookkeeping Accounting Services 3 Website Directions More Info. Get Refund Advance up to 6000 1 No Credit Check.

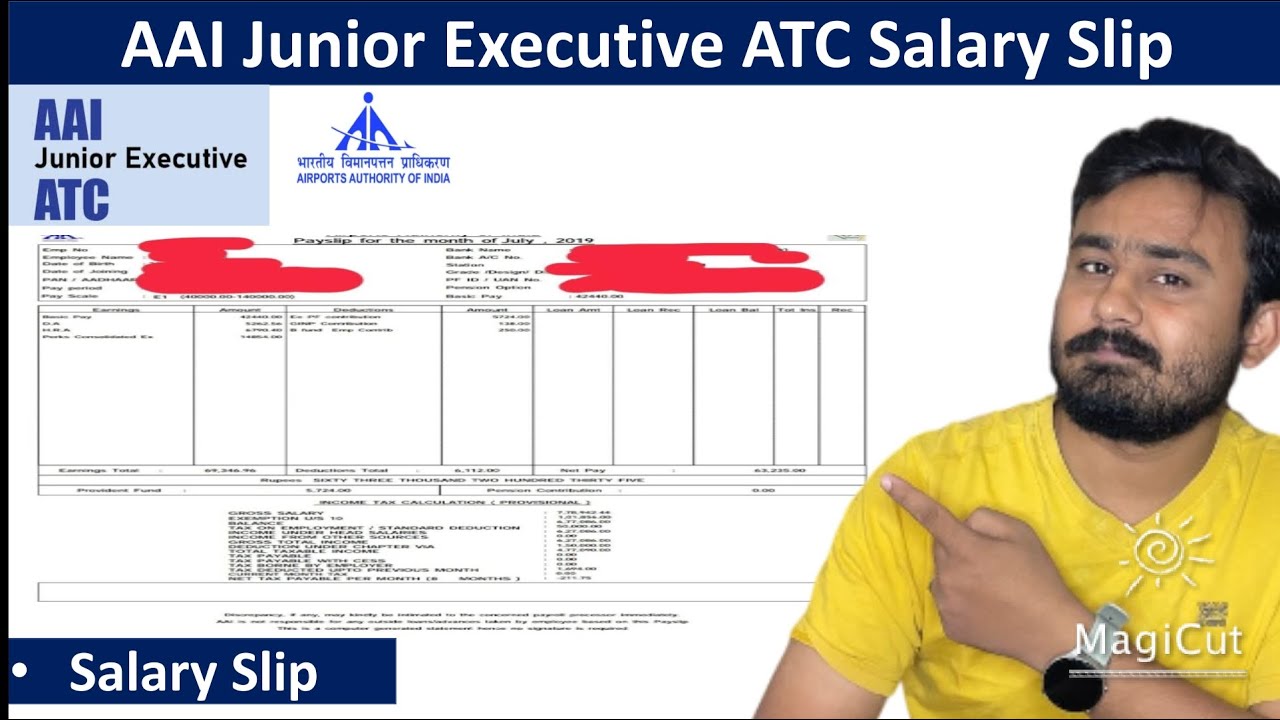

Air Traffic Controller Salary In India Aai Atc Salary

This job was grate it helped me learn a lot of new thinngs in a new work enviorment.

. B All assesses other than company to whom provisions of section 44AB of the Income Tax Act 1961 are applicable. Ask 1800 180 1961 1961 Income Tax Department. It is deductible from income-tax before calculating education cess.

Seamless e-Filing facility for uploading of Income Tax Returns anywhere and anytime around the clock About 20000000 returns filed till 31st Aug 15 in current financial year. The amount of eligible credit is arrived upon those invoices or debit notes the details of which have been uploaded by the suppliers in the GSTR-2A only. ATC is a premier tax preparation firm with a core focus in individual and small business tax services.

1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML. Was this review helpful. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign Income and Assets and Imposition of Tax Act 2015 Central Board of Revenue Act 1963 Charitable And Religious Trusts Act 1920 Charitable Endowments Act.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards. O Tax Preparer Current Employee - 27th state milwaukee wi - June 4 2013. Skip to main content.

ATC Income Tax benefits and perks including insurance benefits retirement benefits and vacation policy. Even the section 80CCC on pension scheme contributions was merged with the above 80C. Promotion to the grade of Assistant Commissioner of Income-Tax ACIT.

To stay updated. Ask 1800 180 1961 1961 Income Tax Department. Reported anonymously by ATC Income Tax employees.

Employee Contribution Under Section 80CCD 1. A maximum of upto 10 of salary for employees or 20 of gross total income for self-employed individuals. 12500 whichever is less.

Tax deductions under Section 80CCD are categorised in three subsections. ATC Income Tax offers exceptional tax service in Atlanta Milwaukee area while specializing in Refund Advance options. The tax deduction can be claimed by individuals whether resident or non-resident.

Let us assume that DA will be 10 for next year. What is the phone number of ATC Income Tax Office. Celebration of Income Tax Day 2021 Hosting of Web Conference for Officers and Officials of the department - regarding.

This income tax exemption is allowed to HUF members as well as non-HUF members. ATC India is an indirectly-held subsidiary of American Tower Corporation. What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora.

Skip to main content. Of years of completion of service. A All corporate assesses.

The amount of the advance 200 to 500 will be deducted from tax refunds and reduce the amount. All tax returns are backed by our Triple-A Promise. Atc income tax india Monday June 6 2022 Edit.

Income Tax India. Tax deducted or collected at source shall be deposited to the credit of the Central Government by following modes. Atc Income Tax in Indian Creek FL.

Section 80C replaced the existing Section 88 with more or less the same investment mix available in Section 88. Us 80C you are able to reduce Rs150000 from your taxable income. Find your nearest ATC office and make an appointment today.

Under section 80CCC income tax deduction for the contributions made in specified pension plans can be claimed. There are 2 helpful reviews. KUMAR CO Puttur Andhra Pradesh 517583 India Coordinate.

250000 Nil Nil Rs. 15 days salary on the grounds of the salary for each finished year of service or the portion thereof in excess of 6 months that is 1526 Salary pm. As per the new rule a taxpayer filing GSTR-3B can claim provisional Input Tax Credit ITC only to the extent of 10 of the eligible credit available in GSTR-2A.

A maximum of Rs150000 can be asserted for the financial year 2021-2011 2022-2023 each. Towards the intention of the mentioned calculation the salary will be rendered as basic salary per month along with the Dearness. You can try to find more information on their website.

Maximum permissible deduction under sections 80C 80CCC and 80CCD 1 put together is Rs. However this new section has allowed a major change in the method of providing the tax. Non-resident individualHUF Net income range Income-tax rates Health and Education Cess Up to Rs.

By furnishing the. IRS Officers Online. The limit is capped at 15 lakh aggregate of 80C 80CCC and 80CCD.

E-Payment is mandatory for. The new section 80C has become effective wef. To stay updated.

Name A - Z Ad All Accounting Services. The amount of rebate is 100 per cent of income-tax or Rs. Income Tax India.

The corporate income-tax CIT rate applicable to an Indian company and a foreign company for the tax year 202122 is as follows.

Gowtham Co Tax Consultants Home Facebook

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

Atc Healthcare Philadelp Hia Overview Signalhire Company Profile

All About Filling Of Eform Aoc 4 Income Tax Return Indirect Tax Income Tax

Income Tax Return 2021 Lost Money In Stock Markets Check If You Can Set It Off Against Salary Income The Financial Express

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

What Is The Income Tax Slab Rate For Ay 2020 21 Quora

Income Tax Return Filing A List Of I T Rules That Have Changed This Year

Budget 2022 Highlights Pdf Free Pdf Download In 2022 Budgeting Income Tax The Borrowers

Have You Done This Work Related To Income Tax The Center Warned At The End The Indian Nation

Checklist For Indian It Professionals Filing Individual Income Tax Returns Aotax Com

Aai Junior Executive Salary Slip Aai Junior Executive Perks Allowance Sarkari Naukri Vale Baba Youtube

What Is The Approximate In Hand Salary Of An Atc After 3 Years On The Job Quora

Air Traffic Controller Salary In India Aai Atc Salary

What Is The In Hand Salary Of A Newly Recruited Aai Je Airport Operations Quora

What Will Be The In Hand Salary Per Month Of An Aai Junior Executive Quora